Ky. tax reform is a political bomb no one wants to touch, but alternatives are brutal

Published 6:03 am Monday, January 22, 2018

FRANKFORT — The catchphrase of Gov. Matt Bevin’s State of the Commonwealth and budget speech Tuesday night was “get our financial house in order.” But if you listened closely, you heard the same message as last year: We need more money.

“Nobody likes the idea of having to cut budgets. Nobody likes the idea of having to make these difficult decisions. There is not enough money,” Bevin said without qualification as he began to wrap up.

“So many of the things that we need – the protection, the infrastructure and the education – can barely be paid for … Then there’s all the things that we want. If we want more of what we want, then we’re ultimately going to have to have the resources to pay for it.” He said more resources will come from economic growth – he had spent some time talking about the state’s banner year of deals to create jobs – and “getting a tax structure.”

That last phrase was a reference to an earlier passage: “Tax reform is coming. It is coming. Whether it comes as a part of this session, time will tell. It depends on the bandwidth and the appetite and the opportunity that beholds us. But we will in 2018 address tax reform, and it’s not simply going to be, as some would have it to be, just raising taxes.”

The last line was a straw man, a sop to the governor’s anti-tax base. No one is talking about “reform” that just raises taxes. But Bevin’s inclusion of “just” showed that he remains where he was on this critical issue in last year’s State of the Commonwealth: The state needs more revenue and should kill some of the “sacred cows” that enjoy billions in exemptions from taxes.

That makes tax reform the most difficult task lawmakers can tackle, and that’s the main reason it hasn’t really been done for decades – the tax base has eroded as the tax code fails to reflect the realities of the economy, and the state budget has been cut again and again over the past 10 years.

Bevin’s good idea of a special session to reform both taxes and pensions, using the former to fund the latter, was a non-starter with his fellow Republicans. It’s not in their political DNA. As the late conservative commentator Robert Novak said, “God put the Republican Party on Earth to cut taxes,” not raise them.

And while Republicans enjoy an impregnable 27-11 majority in the Senate, their 63-36 majority in the House is subject to this year’s elections. They have 23 House freshmen who are running for re-election for the first time, and they have reason to be nervous.

President Trump’s antics may create a national Democratic wave, and Bevin’s popularity has suffered from his unpopular pension-reform plan, now being redrafted. On the other hand, so many House Democrats are retiring that Republicans could pick up some of those seats this fall.

The landscape will be less foggy after the Jan. 30 filing deadline for primary elections. Democrats who are thinking about running for the legislature, but also want to see that schools and state services are properly funded, might want to hold off. The greater the fear of electoral retribution for raising taxes, the more likely the state will continue to lose ground.

Bevin’s bleak budget, with its list of 70 programs that he wants to de-fund, gives the public a taste of what it will mean to get the state’s financial house in order without tax reform. And there is a growing realization among legislators and those who lobby them that the state can’t keep kicking the tax can down the road, just as it can’t keep kicking the pension can down the road. Bevin has put a stop to the latter, and he wants to put a stop to the former.

Bevin may even have a tax increase in mind: on tobacco, once the state’s largest cash crop but now without most of the political influence it once had. Republican Sen. Steve Meredith of Leitchfield has a bill to raise the cigarette tax $1 a pack, which would generate about $260 million a year and help Kentucky lose its deadly and costly status as the No. 1 or 2 smoking state.

Bevin’s press release about his speech mentioned the tax, saying he wants “genuine tax reform that will make Kentucky more competitive with its neighboring states, not merely a bump in the sales tax or an increase in the cigarette tax, both of which have been proposed by many.” Not “merely,” but not ruling it out. This week the Senate health committee endorsed the cig tax. Let’s take stock again after Jan. 30.

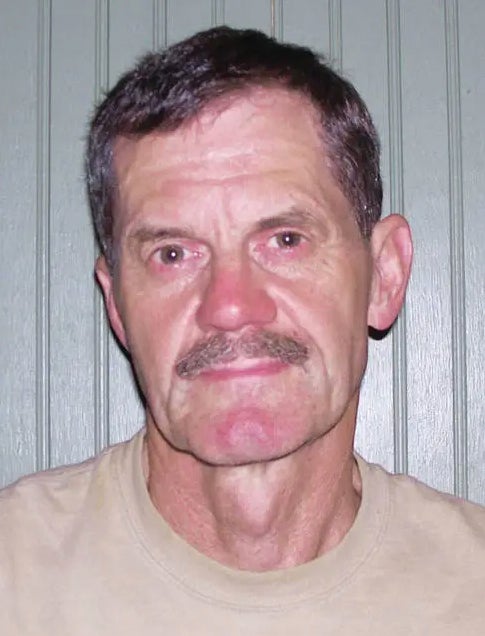

Al Cross, former C-J political writer, is director of the Institute for Rural Journalism and Community Issues and associate professor in the University of Kentucky School of Journalism and Telecommunications. His opinions are his own, not UK’s. This column previously appeared in the Louisville Courier-Journal.