Financial gifts can brighten anyone’s Mother’s Day

Published 10:06 am Thursday, May 9, 2019

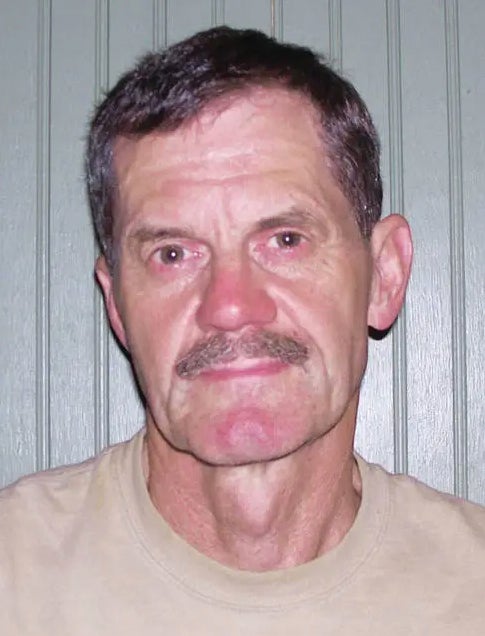

By David Whitlock

Financial Focus

Mother’s Day is fast approaching. This special holiday reminds us of the joy we receive from the powerful bond between mother and child. To help mark the occasion, you may want to consider making certain financial gifts, including the following:

For your mother:

IRA contribution – If your mother is still working, she is eligible to contribute to an IRA, but she might not always fully fund it – so you may want to help. You can’t contribute directly to your mother’s IRA, but you can write her a check for that purpose, though, of course, she can use the money however she likes. In 2019, the contribution limit for a traditional or Roth IRA is $6,000, or $7,000 for individuals 50 or older. (A Roth IRA does have income limits that can reduce the contribution amount or eliminate it altogether.)

Insurance premium – If your mother has life, disability or long-term care insurance, why not offer to pay some of the premiums this year? Long-term care premiums, in particular, can be quite costly, especially for older policyholders.

Introduction to a financial professional – If your mother doesn’t already work with a financial professional, consider introducing her to yours, or to someone else who is recommended by friends or relatives. A financial advisor can help your mother move toward her retirement goals – and, at some point, also can work with legal and tax professionals to assist your mother with her estate plans.

For your children:

529 plan contribution – If your children are still of school age, you may want to contribute to a college savings vehicle. One popular choice is a 529 savings plan. When you invest in this plan, your earnings can grow tax-free, provided the money is used for qualified educational expenses. (Be aware, though, that withdrawals not used for qualified education expenses may be subject to federal and state taxes, as well as an additional 10% penalty.)

As the 529 plan owner, you have flexibility in using the money. For example, if you’ve designated one of your children as the 529 plan’s beneficiary, and that child decides not to pursue any higher education, you can switch the beneficiary designation to another child or to yourself.

You can choose the 529 plan offered by any state, but your contributions might be tax deductible if you invest in your own state’s plan. Tax issues for 529 plans can be complex, so, before investing, consult with your tax advisor.

Shares of stocks – Giving stock shares to children is a good way to help them learn some of the basics of investing. You can track the progress of their stocks with them, and even do some research together about why prices may be going up or down. By getting children involved early, you may help instill a lifelong interest in investing.

Charitable gifts – Many children are now concerned about various social issues. You can help encourage this involvement – and possibly an appreciation of the value of philanthropy – by making a gift to a charitable group whose work aligns with your child’s interests.

We don’t need to exchange presents on Mother’s Day to show our appreciation for one another, but certain financial gifts can help provide needed support – and even some valuable life lessons – for your loved ones.

This article was written by Edward Jones for use by your local financial advisor, David Whitlock. Member SIPC.