County property tax rates unchanged

Published 7:19 pm Thursday, August 23, 2018

Joe P. Asher|Daily Enterprise

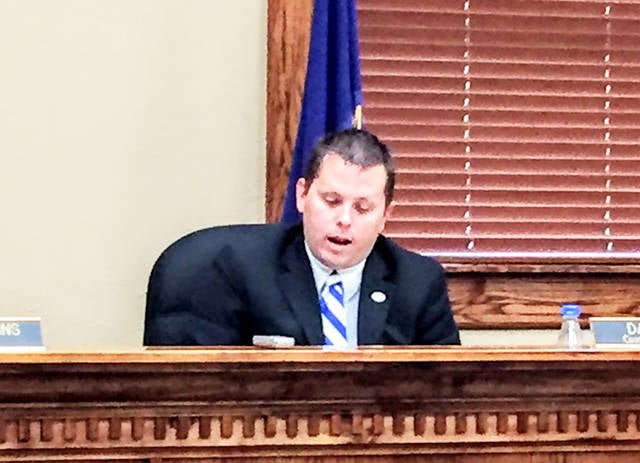

Harlan County Judge-Executive Dan Mosley discusses property tax rates during a meeting on Wednesday.

The Harlan Fiscal Court decided to leave property tax rates unchanged during a meeting on Wednesday.

Harlan County Judge-Executive Dan Mosley brought the subject up to the magistrates.

“The last couple of years, each year it’s been recommended by the state that we raise our rate,” Mosley said. “For the last two years, the fiscal court rejected raising the property tax rate.”

Mosley said the current rate for real property is .415 cents per $100 of assessed value.

“It has been that since 2015,” Mosley said.

Harlan County Treasurer Ryan Creech added the state recommended increasing the rate to .456 cents per $100 of assessed value.

“We’ve been very aggressive in the area of grants,” Mosley said. “We’ve cut expenses. I’m comfortable with where we’re at from the standpoint of what we’ve cut. We’re managing accordingly and we’re not biting off more than we can chew. I do not favor an increase in the real property rate.”

Mosley said the state assessment of real property values went down approximately $10 million.

“That’s pretty good,” Mosley said. “We’ve seen $200 million deficits in that area over the past few years. It was better than what we’ve had before. I’m comfortable recommending that we do not increase the real property rate and stay at the current rate.”

The magistrates passed a motion leaving the real property tax rate unchanged. The motion passed with no opposition.

The magistrates then moved on to the tangible property rate, which impacts commercial property.

“We received the assessment and noticed it was down…$49 million of that being tangible,” Mosley said. “That’s ridiculous, you never see that type of decline on tangible. After further review, we contacted the state and asked them to reevaluate that.”

Mosley explained the Department of Revenue’s recommendation would increase the tangible property rate by approximately 300 percent.

“The assessment was incorrect,” Mosley explained. “They had not processed a form that had been submitted locally by a large company…therefore, when the Department of Local Government calculated the rate, it made the rate soar.”

Mosley said the state is aware of the error.

“We asked yesterday for the department of revenue to do a new assessment based on that information,” Mosley explained. “They’ve informed us they are not redoing the assessment…but that rate is not right. It’s a false rate. And what they’ve asked us to do is increase the rate on people who pay tangible property tax almost 300 percent.”

Mosley said he did not agree with an increase.

“It’s a bad practice that they wouldn’t go back and recalculate the assessment,” Mosley said. “There’s no doubt that many counties across the state…have probably passed rates not even noticing this. That’s not fair to everyone else in the community.”

Mosley explained if the rate remains the same, there will be a loss.

“We’ll still go backwards a little bit,” Mosley said. “Probably about $30,000 in a year. But, the $30,000 that we would go back would be the $30,000 you just saved by refinancing that bond. My recommendation would be to not raise the tangible rate either, and leave it as it was last year at .4346.”

Mosley said the state recommended the tangible property rate be raised to .5932 cents per $100 of assessed value.

“They’re wanting us to raise people’s taxes even though they know they made a mistake,” Magistrate David Kennedy said. “That’s the craziest thing I’ve ever heard.”

The court passed a motion leaving the tangible property rate unchanged. The motion passed with no opposition.